What is the US Foreign Drone Ban?

The US foreign drone ban is an FCC regulation that added all foreign-manufactured unmanned aircraft systems to the Covered List, blocking new models from receiving FCC authorization for sale in the United States and fundamentally reshaping commercial drone operations for American service providers.

The United States has implemented sweeping restrictions on foreign-manufactured drones that fundamentally reshape the commercial unmanned aircraft landscape. The Federal Communications Commission's addition of all foreign-made unmanned aircraft systems to its Covered List on December 22 creates unprecedented challenges for drone operators, aerial service providers, and the broader commercial aviation sector.

This regulatory shift extends far beyond the anticipated restrictions on Chinese manufacturers like DJI and Autel. The new framework prohibits FCC authorization for any new foreign-manufactured drone, effectively freezing technological advancement in the consumer and commercial drone markets until domestic alternatives emerge.

The implications ripple through multiple industries that rely on drone technology for inspection services, surveying operations, agricultural monitoring, and emergency response capabilities. Understanding these changes becomes critical for operators managing existing fleets and planning future acquisitions.

Table of contents

- Understanding the FCC Covered List restrictions

- Current drone market composition

- Impact on commercial drone operations

- Fleet management considerations

- Alternative drone manufacturers and options

- Economic implications for service providers

- Regulatory exceptions and approval pathways

- Timeline expectations for market recovery

- Frequently Asked Questions

- Implementation considerations

- In summary

Understanding the FCC Covered List restrictions

The FCC Covered List functions as a regulatory mechanism that prevents federal agencies from purchasing or authorizing equipment deemed to pose national security risks. The December addition specifically targets "uncrewed aircraft systems (UAS) and UAS critical components produced in a foreign country."

This designation blocks new foreign drone models from receiving the mandatory FCC authorization required for legal sale in the United States. Any device with communication capabilities, including Wi-Fi, cellular, or radio frequency transmission, must obtain FCC approval before reaching American consumers or businesses. Operators should ensure their compliance tracking systems account for these new restrictions.

The restriction applies exclusively to new product authorizations. Existing drone models that previously received FCC approval remain available for purchase and operation. This grandfathering provision provides temporary relief for operators but creates uncertainty about long-term equipment availability.

Federal agencies retain authority to grant individual exceptions through the Department of Defense or Department of Homeland Security. These approval pathways may provide alternatives for specific use cases or critical applications, though the criteria and processes remain undefined.

Current drone market composition

The commercial drone market has been dominated by foreign manufacturers for over a decade. Chinese companies, particularly DJI, control approximately 70% of the global market share, with their products ranging from consumer-grade aircraft to sophisticated industrial platforms.

Key foreign manufacturers affected by the restrictions include DJI as the market leader spanning consumer, prosumer, and enterprise segments, Autel as a secondary Chinese manufacturer focusing on commercial applications, and various other producers serving the entry-level consumer and specialized industrial markets.

The scarcity of domestic alternatives becomes apparent when examining American drone companies. Most US-based manufacturers have pivoted away from consumer markets toward specialized enterprise, military, or industrial applications. This exodus left the consumer market almost entirely dependent on foreign production.

Former consumer drone manufacturers like Skydio shifted focus to enterprise markets after struggling to compete with foreign pricing and feature sets. This transition affects operators who need to start a drone business or scale existing operations.

Impact on commercial drone operations

Commercial operators face immediate strategic decisions about fleet expansion and replacement planning. Service providers in construction inspection and power line monitoring must reconsider equipment procurement strategies that previously relied on regular technology upgrades.

The freeze on new model introductions affects several operational aspects. Technology stagnation means operators cannot access improvements in battery life, sensor capabilities, or flight performance that would typically arrive through annual product cycles.

Competitive disadvantage emerges when companies in international markets gain access to superior equipment unavailable to US-based competitors. Service limitations affect certain specialized applications that may become impossible without specific drone capabilities that only newer models provide.

The restriction particularly impacts businesses conducting cell tower inspections and utilities monitoring. Inspection companies using thermal imaging, surveyors requiring high-precision GPS, and agricultural services needing multispectral sensors face potential operational constraints.

Fleet management considerations

Existing drone fleets require enhanced maintenance protocols and lifecycle planning to maximize operational longevity. Operators must prioritize preventive maintenance, spare parts inventory, and backup equipment to mitigate risks from equipment failure.

Strategic fleet management now involves several critical decisions:

| Consideration | Impact | Strategy |

|---|---|---|

| Spare parts inventory | Limited future availability | Increase current stock levels |

| Backup aircraft | No replacement options | Acquire redundant units immediately |

| Maintenance schedules | Extended equipment life needed | Implement more frequent inspections |

| Operator training | Maximize current equipment value | Cross-train on multiple platforms |

Operators should evaluate their current equipment mix to identify potential gaps or vulnerabilities. Fleets heavily dependent on single manufacturers or model types face greater risks from equipment failure or obsolescence.

The economic value of existing equipment may increase as new alternatives become unavailable. This creates both opportunities and challenges for fleet valuation and insurance considerations.

Alternative drone manufacturers and options

The domestic drone manufacturing landscape offers limited alternatives for most commercial applications. Several American companies produce specialized aircraft, but few target the broader commercial market segments previously served by foreign manufacturers.

Skydio represents the most prominent US alternative, though their focus has shifted primarily to enterprise and government markets. Their X10 platform offers advanced autonomous capabilities but at significantly higher price points than consumer alternatives.

Teal Drones produces the Golden Eagle, designed specifically for government and enterprise applications. While capable, these platforms target specialized use cases rather than general commercial operations serving surveying and inspection markets.

Freefly Systems manufactures high-end cinematography and industrial drones. Their products serve professional film production and specialized industrial applications but lack the versatility needed for broader commercial markets.

Several companies previously focused on military or specialized applications may pivot toward commercial markets in response to reduced competition. However, this transition requires significant investment in manufacturing capabilities, distribution networks, and customer support infrastructure.

Economic implications for service providers

Service pricing structures face potential disruption as equipment costs increase and availability decreases. Operators may need to adjust billing models to account for higher equipment amortization costs and reduced operational efficiency from aging fleets.

The market dynamics create several economic pressures. Increased equipment costs reflect that domestic alternatives typically command premium pricing compared to foreign competitors. Extended payback periods mean higher initial investments require longer amortization schedules.

Reduced operational efficiency occurs when older equipment requires more frequent maintenance and provides lower productivity. Operators using drone operations software can better track these efficiency metrics and plan accordingly.

Service providers should evaluate contract structures and pricing models to account for these changing dynamics. Fixed-price contracts may become financially challenging if equipment costs increase significantly.

Some operators may consider international partnerships or offshore subsidiaries to maintain access to advanced equipment for specific projects. However, these arrangements introduce additional complexity and potential regulatory complications.

Regulatory exceptions and approval pathways

Federal agencies retain authority to approve foreign-made drones through specific exception processes. The Department of Defense and Department of Homeland Security may grant individual authorizations for critical applications or national security purposes.

These exception pathways remain largely undefined, creating uncertainty about approval criteria, processing timelines, and eligible use cases. Operators requiring specialized capabilities may need to work directly with federal agencies to obtain necessary authorizations.

State and local government agencies may face particular challenges procuring equipment for public safety, emergency response, or infrastructure inspection applications. These entities often require specific performance capabilities that domestic alternatives cannot currently provide.

The exception process may prioritize sectors including critical infrastructure inspection, emergency response operations, public safety applications, scientific research projects, and agricultural monitoring for food security. Organizations should maintain current Part 107 certification and pilot qualifications to remain eligible for exception pathways.

Understanding these priorities becomes important for organizations seeking exception approvals or planning equipment procurement strategies. The FAA's commercial drone regulations continue to apply alongside these new FCC restrictions.

Timeline expectations for market recovery

Domestic drone manufacturing capabilities require substantial development timelines that could extend the current equipment shortage for several years. Historical precedent suggests that developing competitive consumer drone platforms requires 3-5 years of intensive engineering and manufacturing investment.

Several factors influence recovery timelines. Manufacturing infrastructure requires building domestic production capabilities through significant capital investment. Supply chain development adds complexity because critical components often rely on international suppliers.

Talent acquisition presents challenges as skilled engineers and designers may need recruitment from international markets. Regulatory compliance adds months to development timelines as new platforms must complete certification processes.

Companies with existing drone experience may accelerate development timelines by leveraging current capabilities and partnerships. Manufacturers with previous consumer market experience could potentially return to commercial markets more rapidly than entirely new entrants.

Investment capital availability becomes crucial for funding development efforts. Companies attempting to fill the market gap require substantial financing for research, development, manufacturing, and marketing activities.

Frequently Asked Questions

How long will foreign-made drones that already have FCC approval remain available?

Existing drone models with prior FCC authorization remain available for purchase and operation under the grandfathering provision. However, availability depends on manufacturer inventory levels and retailer stock, so operators should consider current equipment needs when planning acquisitions and fleet maintenance.

Can government agencies still use foreign-made drones?

Federal agencies retain authority to grant individual exceptions through the Department of Defense or Department of Homeland Security for critical applications. State and local agencies may face challenges procuring specialized equipment but can pursue exception pathways for public safety and emergency response applications.

What domestic drone alternatives are available for commercial operators?

The primary US-based alternative is Skydio, offering the X10 platform for enterprise and government markets. Teal Drones produces the Golden Eagle for specialized applications, and Freefly Systems manufactures high-end cinematography platforms. However, these options typically command premium pricing compared to foreign alternatives and may require updated flight planning procedures.

How should operators protect their existing fleet investment?

Operators should prioritize preventive maintenance, increase spare parts inventory, acquire backup aircraft, and cross-train pilots on multiple platforms to maximize operational longevity of existing equipment. Implementing comprehensive pre-flight checklists helps extend equipment life.

Implementation considerations

Commercial operators navigating the foreign drone restrictions should prioritize immediate fleet assessment and long-term procurement planning. Organizations should evaluate current equipment mix, identify potential gaps, and develop contingency strategies for equipment replacement.

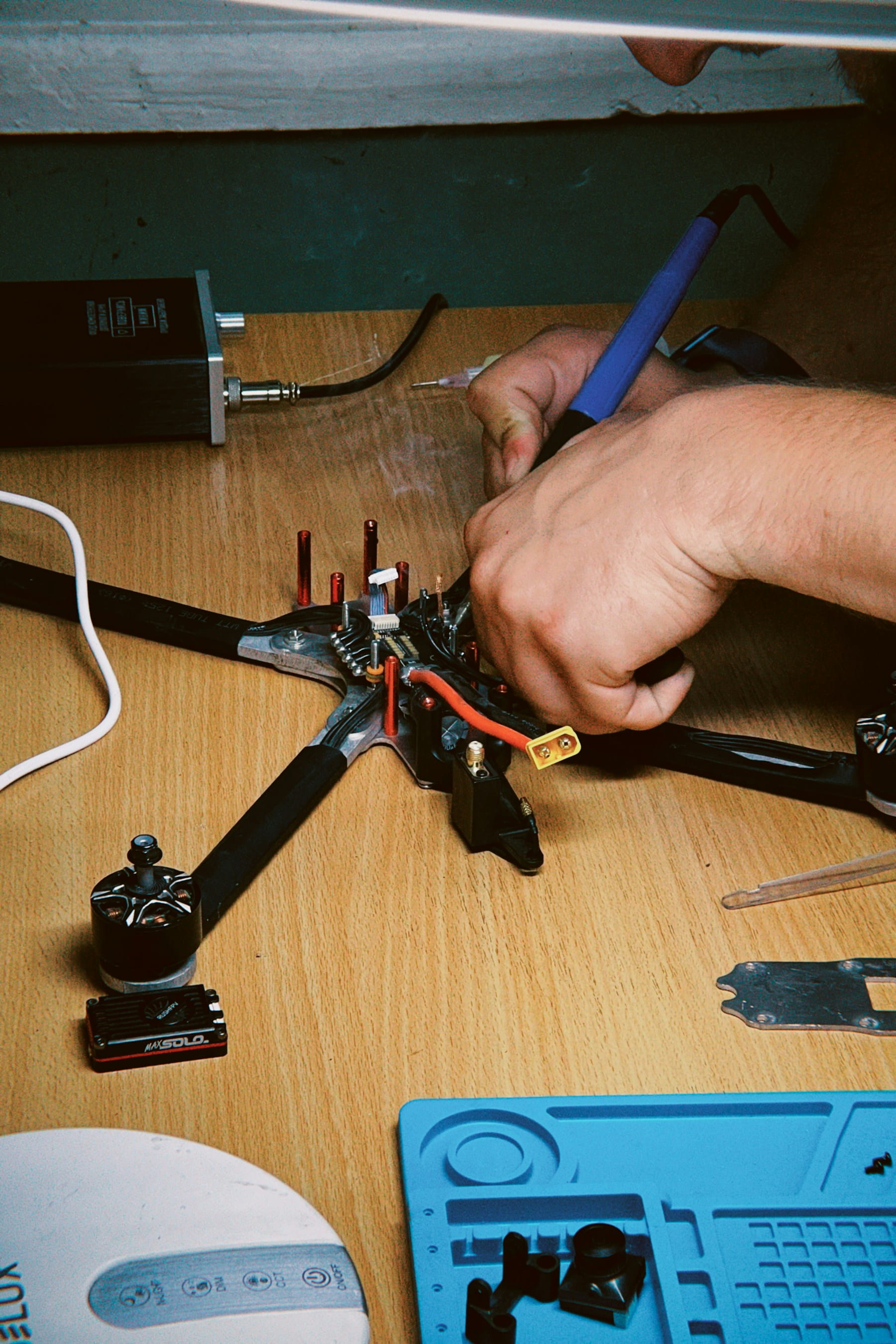

Integration of comprehensive fleet management platforms becomes critical during this transition period. Modern solutions help operators track equipment status, coordinate maintenance schedules, and plan operations across regulatory constraints while maximizing value from existing assets. Teams conducting telecom tower inspections and other specialized operations need particular attention to equipment continuity.

Teams should also consider diversification strategies, including expanded service offerings, international partnerships, and investment in pilot training programs that prepare crews for new domestic equipment as it becomes available. Operators can explore live tracking capabilities to maximize visibility into fleet utilization during this transition.

In summary

The foreign drone restrictions represent a watershed moment for American drone operations. While short-term challenges are significant, the long-term outcome depends on how effectively domestic manufacturers respond to the market opportunity and how quickly operators adapt their business strategies to the new landscape.

Success in this environment requires careful planning, strategic thinking, and operational flexibility. Operators who proactively address equipment constraints while positioning for future opportunities will be best prepared to thrive as the market eventually stabilizes around new domestic alternatives.

The emergence of domestic manufacturing capabilities could reshape global competitive dynamics and technology development patterns. Organizations that establish robust management foundations now will be better positioned to adapt to technological advancement and regulatory changes while maintaining operational excellence.

Ready to optimize your fleet during the transition?

The foreign drone restrictions create unprecedented challenges for commercial operators, but systematic fleet management helps teams maximize existing equipment value while preparing for domestic alternatives. Whether you are tracking maintenance schedules, coordinating pilot certifications, or planning equipment procurement, comprehensive management tools provide the visibility needed for strategic decision-making.

Start your free trial today - no credit card required.

Or book a demo to see how DroneBundle helps operators navigate equipment constraints with automated maintenance scheduling and flight data monitoring.