What is Drone Insurance?

Drone insurance is specialized coverage that protects unmanned aircraft operators from financial losses due to equipment damage, third-party liability claims, and operational risks. Commercial drone insurance typically includes hull coverage for the aircraft itself, liability coverage for bodily injury and property damage, and payload protection for sensors and cameras.

Drone insurance has become essential for commercial operators as the industry matures and clients increasingly require proof of coverage before authorizing flights. While the FAA does not mandate insurance for Part 107 operations at the federal level, most professional drone businesses carry coverage to protect against potentially devastating liability claims and equipment losses.

The commercial drone insurance market offers coverage options ranging from pay-per-flight policies starting at $5 per hour to comprehensive annual plans with liability limits up to $25 million. Understanding the different coverage types, cost factors, and provider options helps operators select appropriate protection for their specific operational needs.

Table of contents

- Types of drone insurance coverage

- Do you legally need drone insurance

- How much does drone insurance cost

- Top drone insurance providers

- How to choose the right policy

- Filing a drone insurance claim

- Common exclusions to watch for

- Frequently asked questions

- Implementation considerations

- In summary

Types of drone insurance coverage

Commercial drone operations face multiple risk categories that require different types of insurance coverage. Understanding these coverage types helps operators build comprehensive protection without paying for unnecessary coverage.

Liability insurance

Liability coverage protects against claims when your drone causes bodily injury or property damage to third parties. This represents the most critical coverage type for commercial operators, as a single incident could generate claims exceeding the value of your entire business.

Third-party liability policies typically cover legal defense costs, settlement payments, and court judgments. Coverage limits commonly range from $500,000 to $10 million per occurrence, with most commercial clients requiring minimum coverage of $1 million. Operations near construction sites or utility infrastructure often require higher limits due to increased risk exposure.

Personal injury liability addresses claims related to invasion of privacy, defamation, or other non-physical harms. Given the sensitive nature of aerial imaging and data collection, this coverage addresses modern concerns that traditional aviation policies may not cover adequately.

Hull insurance

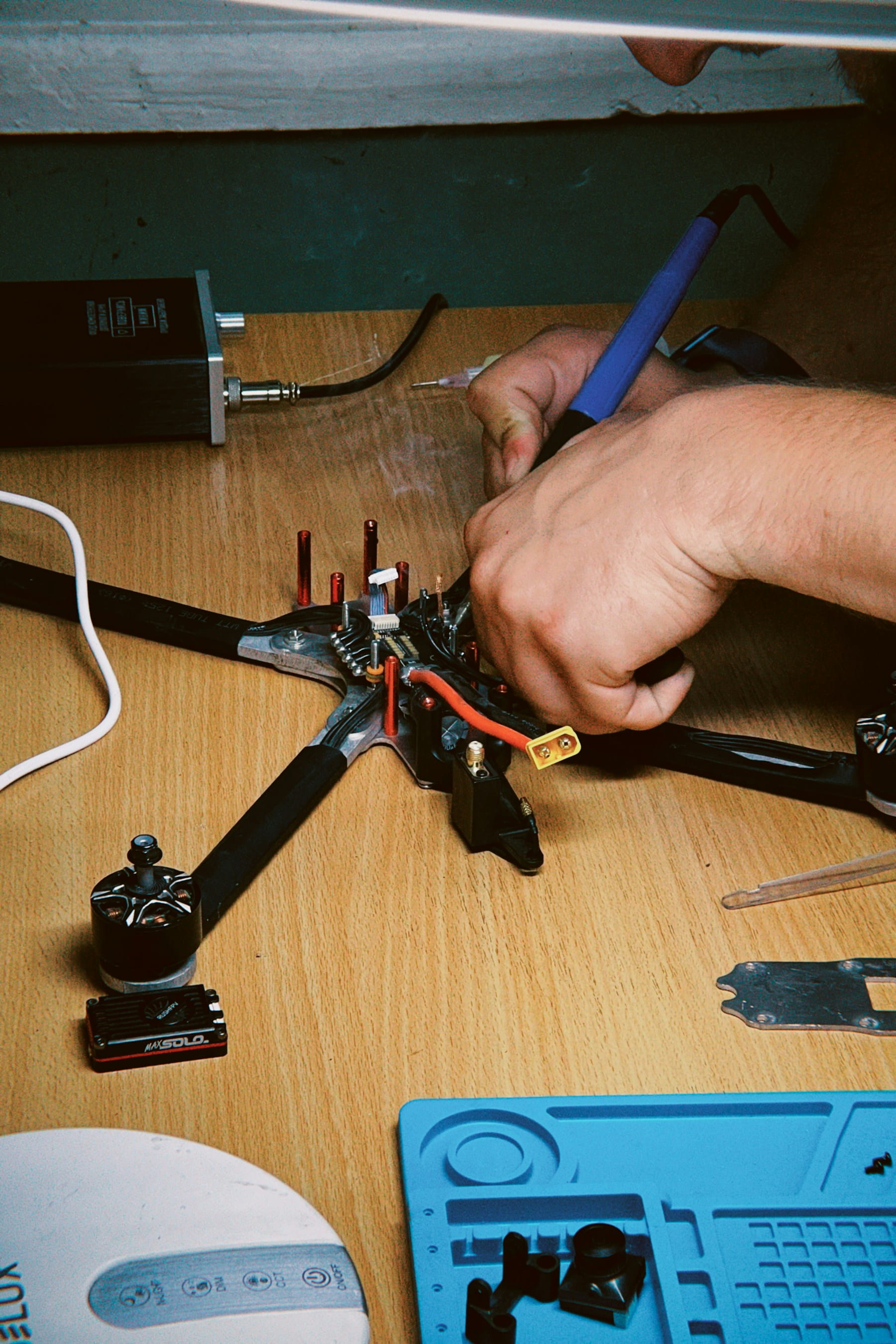

Hull coverage protects against physical damage to your aircraft and attached equipment. This includes coverage for crashes, hard landings, flyaways, and mechanical failures. Hull policies may be structured as ground risk coverage (protecting equipment while not flying) or in-flight coverage (protecting during operations).

Most hull policies cover the drone frame, propulsion system, gimbal, and permanently attached cameras. Removable payloads like thermal cameras, LiDAR sensors, and multispectral imaging systems may require separate equipment coverage or scheduled item endorsements.

Payload coverage

Professional payloads often exceed the value of the aircraft itself. A survey-grade camera system or thermal imaging sensor can cost $20,000 to $50,000, making dedicated payload coverage essential for operators using specialized equipment.

Payload policies typically cover physical damage, theft, and sometimes calibration loss due to impact or environmental exposure. Coverage should specify whether items are protected during transit, storage, and active operations.

Personal injury coverage

Beyond physical damage, drones can cause privacy violations, emotional distress, and reputational harm. Personal injury coverage addresses these claims, which are becoming more common as drone operations expand into residential areas and sensitive environments.

Do you legally need drone insurance

The FAA does not currently require liability insurance for Part 107 operations at the federal level. However, insurance requirements come from multiple other sources that effectively make coverage mandatory for most commercial operators.

Federal requirements

While 14 CFR Part 107 establishes rules for commercial drone operations, it does not include insurance mandates. Operators remain legally liable for damages caused by their aircraft regardless of insurance status, meaning uninsured operators face personal financial exposure for any incidents.

Certain waiver operations and advanced authorizations may include insurance requirements as conditions of approval. Operations involving flights over people, night operations in congested areas, or beyond visual line of sight missions increasingly require proof of coverage.

State and local requirements

Several states have implemented drone insurance requirements that exceed federal standards. According to the Insurance Information Institute, state regulations vary significantly:

| State | Requirement |

|---|---|

| California | $1 million minimum liability for most commercial operations |

| North Carolina | Adjuster license required for insurance inspection work |

| Texas | Adjuster license required for insurance-related drone work |

| Florida | Must work with licensed adjuster for insurance claims |

| North Dakota | $100,000 minimum liability for commercial operators |

Many municipalities require permits and insurance for drone operations over public property. Cities like New York and Los Angeles have specific requirements for commercial filming and event coverage.

Client and contract requirements

Most commercial clients require proof of insurance before authorizing drone operations on their property. Standard requirements typically include:

- $1 million to $2 million general liability coverage

- Additional insured endorsement naming the client

- Certificate of insurance delivered before work begins

- Hull coverage for operations over sensitive property

Real estate companies, construction firms, and government agencies almost universally require insurance documentation. Operators starting a drone business should factor insurance costs into their pricing from the beginning.

How much does drone insurance cost

Drone insurance costs vary based on coverage types, limits, operational risk profile, and provider. Understanding cost factors helps operators budget appropriately and identify opportunities to reduce premiums.

Liability insurance costs

Annual liability policies for Part 107 operators typically cost between $500 and $2,000 for $1 million in coverage. Factors affecting pricing include:

- Geographic territory - Operations in urban areas or near airports cost more

- Flight frequency - Higher annual flight hours increase premiums

- Industry sector - Inspection work and operations near infrastructure carry higher rates

- Claims history - Previous losses significantly impact future premiums

- Pilot experience - Documented flight hours and training can reduce rates

On-demand coverage offers flexibility for operators with irregular flight schedules. Hourly policies start around $5 to $15 per flight hour, making them cost-effective for occasional commercial work.

Hull insurance costs

Hull coverage typically costs 5% to 12% of the aircraft's insured value annually. A $5,000 drone would cost approximately $250 to $600 per year for hull coverage. Factors affecting hull premiums include:

- Aircraft value and replacement cost

- Deductible amount selected

- Operational environment and risk profile

- Pilot experience and training credentials

Higher deductibles reduce premiums but increase out-of-pocket costs for claims. Most commercial operators select deductibles between $250 and $1,000 depending on their risk tolerance and cash reserves.

Combined policy pricing

Most providers offer combined policies including both liability and hull coverage. Typical annual premiums for commercial operators:

| Coverage Level | Typical Annual Cost |

|---|---|

| $500K liability only | $400 - $700 |

| $1M liability only | $500 - $1,200 |

| $1M liability + hull | $800 - $2,500 |

| $2M liability + hull | $1,200 - $3,500 |

Fleet operators managing multiple aircraft often qualify for volume discounts. Policies covering 5+ drones may reduce per-aircraft costs by 15% to 25%.

Top drone insurance providers

The drone insurance market has consolidated around several primary providers. Each offers different strengths depending on operational needs and coverage preferences.

SkyWatch

SkyWatch has emerged as the leading on-demand drone insurance provider in North America, offering both hourly and annual policies through a mobile app. Key features include:

- Hourly coverage starting at $5 per flight

- Annual policies from approximately $62 per month

- Liability limits up to $10 million

- Hull coverage available

- Safety score program that rewards safe flying with lower rates

- Policies underwritten by Global Aerospace

SkyWatch works well for operators needing flexible coverage or those building their commercial operations. The app-based platform enables quick certificate generation for client requirements.

BWI Aviation Insurance

BWI represents the traditional aviation insurance approach, offering comprehensive coverage through experienced aviation brokers. With over 55 years in aviation insurance, BWI provides:

- Liability limits up to $25 million

- Comprehensive hull and equipment coverage

- Worldwide coverage options

- Claims advocacy and support

- Multiple carrier options for competitive pricing

BWI is better suited for established drone service businesses requiring high coverage limits or specialized policy structures. Annual policies start around $575 for hobbyist-level coverage and $3,200+ for commercial fleet operations.

State Farm and Traditional Insurers

Traditional insurance companies have entered the drone market, often as endorsements to existing business policies. These options may provide cost savings for operators already insured with these carriers but may have coverage gaps specific to aviation risks.

Important Note: Verifly, previously a popular on-demand provider, has ceased operations. Operators previously using Verifly should secure alternative coverage immediately.

How to choose the right policy

Selecting appropriate drone insurance requires matching coverage to operational needs while managing costs effectively.

Assess your risk profile

Start by documenting your operational characteristics:

- Annual flight hours and frequency

- Geographic areas of operation

- Industries served and client requirements

- Aircraft and payload values

- Pilot experience and certifications

Operations conducting agricultural surveys face different risks than those performing telecom tower inspections. Your policy should reflect your specific exposure profile.

Match coverage to client requirements

Review contracts and client requirements before selecting coverage. Many operators discover mid-project that their coverage doesn't meet client specifications. Common requirements to verify:

- Minimum liability limits

- Additional insured provisions

- Certificate delivery timelines

- Coverage territory restrictions

Evaluate provider stability

Insurance is only valuable if the carrier can pay claims. Verify provider financial ratings through A.M. Best or similar agencies. Carriers rated A- or better generally demonstrate adequate financial strength for claim payment.

Consider growth plans

Select coverage that accommodates operational growth without requiring complete policy restructuring. If you plan to add aircraft, expand services, or enter new geographic markets, discuss these plans with your broker to ensure policy flexibility.

Filing a drone insurance claim

Understanding the claims process before an incident occurs helps ensure proper documentation and faster resolution.

Immediate response steps

When an incident occurs:

- Ensure safety - Address any injuries and secure the scene

- Document everything - Photograph the aircraft, crash site, and any damage

- Preserve flight data - Download flight logs and telemetry immediately

- Gather witness information - Collect contact details for anyone who observed the incident

- Notify your carrier - Most policies require notification within 24-48 hours

Documentation requirements

Comprehensive documentation supports faster claim resolution. Maintain records including:

- Pre-flight checklists documenting aircraft condition

- Maintenance logs showing proper equipment care

- Weather data for the operation date

- Flight reports with mission details

- Pilot certification and training records

Common claim scenarios

Most drone insurance claims fall into several categories:

- Flyaway incidents - Loss of aircraft control leading to crashes or lost drones

- Collision damage - Impact with obstacles, birds, or other aircraft

- Equipment failure - Motor, battery, or gimbal malfunctions

- Third-party damage - Property damage or bodily injury to others

- Theft - Equipment stolen from vehicles, storage, or job sites

Common exclusions to watch for

Insurance policies contain exclusions that limit or eliminate coverage for specific situations. Understanding these exclusions prevents unpleasant surprises during claims.

Regulatory violations

Most policies exclude coverage for incidents occurring during illegal operations. Flying without proper Part 107 certification, operating in restricted airspace without authorization, or violating airspace regulations typically voids coverage.

Intentional acts and gross negligence

Coverage excludes damage caused intentionally or through gross negligence. Operating with known equipment defects, flying in prohibited weather conditions, or ignoring safety warnings may result in denied claims.

War and terrorism

Standard policies exclude losses related to war, terrorism, or government seizure. Operators working in high-risk areas may need specialized coverage endorsements.

Wear and tear

Hull policies cover sudden damage, not gradual deterioration. Battery degradation, propeller wear, and normal equipment aging are maintenance issues, not insurable events.

Unlisted equipment

Policies only cover equipment specifically listed or meeting policy definitions. Newly acquired drones, borrowed equipment, or specialty payloads may not have automatic coverage. Review your policy when adding equipment and request updates as needed.

Frequently asked questions

Does my homeowner's insurance cover drone operations?

Most homeowner's policies exclude or significantly limit drone coverage, especially for commercial use. Even recreational coverage is often capped at low amounts or excluded entirely. Commercial operators need dedicated aviation or drone policies regardless of homeowner's coverage. According to Pilot Institute, relying on homeowner's insurance for drone coverage leaves most operators significantly underinsured.

Can I get insurance without a Part 107 certificate?

Recreational operators can obtain limited liability coverage, but commercial insurance providers require valid Part 107 certification. Attempting to file a commercial claim without proper certification typically results in denial and potential policy cancellation. Complete your Part 107 certification before purchasing commercial coverage.

How quickly can I get proof of insurance for a client?

On-demand providers like SkyWatch can generate certificates of insurance within minutes through their mobile apps. Traditional brokers typically require 24-48 hours for certificate requests. Build insurance lead time into your project scheduling, especially for clients requiring additional insured endorsements.

Does drone insurance cover crashes caused by software glitches?

Most policies cover crashes regardless of cause, including software failures, GPS errors, and firmware bugs. However, crashes caused by operating unauthorized modifications, beta firmware, or uncertified equipment may be excluded. Maintain equipment compliance with manufacturer specifications to ensure coverage.

Implementation considerations

Implementing comprehensive drone insurance requires integration with broader operational risk management practices. Insurance provides financial protection but doesn't replace proper safety procedures and equipment maintenance.

Start by documenting your current operational profile, including aircraft inventory, annual flight hours, and client requirements. This documentation helps brokers provide accurate quotes and ensures policies match actual operations. Regular policy reviews should accompany operational changes like new equipment purchases or service expansion.

Consider insurance costs when pricing services to clients. Many operators underestimate insurance expenses when developing proposals. Building insurance into project pricing ensures sustainable business operations while meeting client coverage requirements.

In summary

Drone insurance has become a practical necessity for commercial operators, even where not legally required. The combination of client requirements, liability exposure, and equipment investment makes appropriate coverage essential for sustainable drone business operations.

The insurance market offers flexible options ranging from hourly on-demand coverage to comprehensive annual policies with high liability limits. Matching coverage to your specific operational needs, client requirements, and risk tolerance helps optimize protection while managing costs.

Operators who integrate insurance planning with broader business development and risk management practices position themselves for sustainable growth in an increasingly professional industry.

Ready to protect your drone operations?

Professional drone operators trust comprehensive management systems to maintain the documentation and operational records that support favorable insurance terms and efficient claims processing. Whether you're managing pilot certifications, equipment maintenance logs, or flight documentation, systematic operations demonstrate professionalism to insurers and clients alike.

Start your free trial today - no credit card required.

Or book a demo to see how DroneBundle integrates compliance tracking and maintenance management in a platform designed for professional drone operations.